-

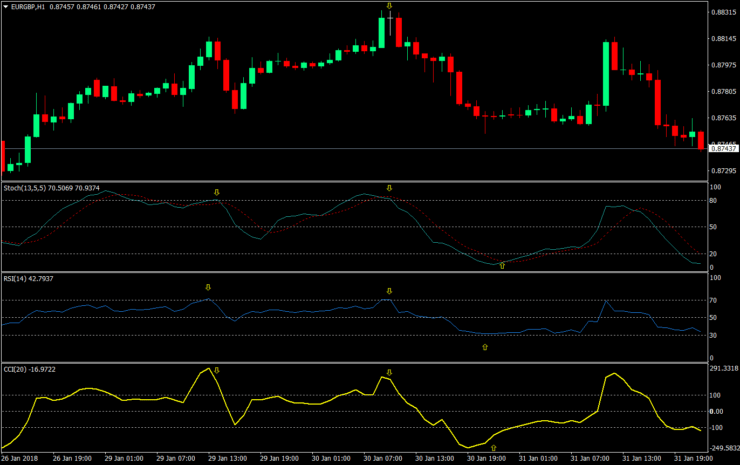

Service for copy trading. Our Algo automatically opens and closes trades.

-

Up to 70 trades per month. There are more than 5 pairs available.

-

The L2T Algo provides highly profitable signals with minimal risk.

-

Real-time alerts, all via Telegram

-

24/7 cryptocurrency trading. While you sleep, we trade.

-

Monthly subscriptions begin at £58

Premium Plan

Premium Plan

Unlock Daily Forex Signals

1 - month

Subscription

-

Up to 5 signals daily

-

76% success rate

-

Entry, take profit & stop loss

-

Amount to risk per trade

-

Risk reward ratio

month

3 - month

Subscription

-

Up to 5 signals daily

-

76% success rate

-

Entry, take profit & stop loss

-

Amount to risk per trade

-

Risk reward ratio

month

Most popular

Most popular

6 - month

Subscription

-

Up to 5 signals daily

-

76% success rate

-

Entry, take profit & stop loss

-

Amount to risk per trade

-

Risk reward ratio

month

Lifetime

Subscription

-

Up to 5 signals daily

-

76% success rate

-

Entry, take profit & stop loss

-

Amount to risk per trade

-

Risk reward ratio

Separate Swing Trading Group

-

Up to 5 signals daily

-

76% success rate

-

Entry, take profit & stop loss

-

Amount to risk per trade

-

Risk reward ratio

month

Become a Professional Forex Trader!

Get LIFETIME access to our VIP forex signals for FREE! Register and deposit the minimum 250 USD with our chosen regulated FX/CFD broker below and receive LIFETIME access to our VIP Forex Signals for FREE!

Choose the best broker in your country

8 cap. The most popular trading platform in the world, with thousands of CFDs. In one location: Indices, FX, Crypto, and more. We go above and above by offering a user-friendly UI and cutting-edge features.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

What’s Included in Our Award Winning Free Forex Signals Telegram Channel

If you are new to the forex market and you would like to get a taste of what our forex signals are like - join our free Forex Signals Telegram channel below!

Join our free telegram group

Daily Technical Analysis & Weekly Webinars

Daily Technical Analysis & Weekly Webinars

Unlock Entry Price

Unlock Entry Price

Up to 5 VIP Forex Signals a day

Up to 5 VIP Forex Signals a day

Mobile Notifications & Telegram Alerts On All Signals

Mobile Notifications & Telegram Alerts On All Signals

Alerts On Economic Events

Alerts On Economic Events

Best Forex Signals Provider 2024

Meet Our Professional Traders

-

Experts in the main financial markets

-

Chat 24/7 with our pro traders

-

Live webinars

-

Free and VIP Signals

-

Best forex signals

-

Full technical analysis

-

Every question will be answered

What’s Included In Our VIP Forex Signals Telegram Channel

Join our existing 3500+ members from all over the world who have been profiting from our VIP forex signals and become professional traders.

Here is more proof of our results

Read our trust pilot reviews on our Forex Signals to understand that you wnat to improve you trading skills

What’s Included in Our Free Forex Signals Telegram Group

Join our 40000+ members in the FREE forex signals Telegram group, no details required just click the button and join without paying anything!

Our Traders Have Been Scouted From Trading Floors Based All Over the World!

FAQ About Forex Signals

What are Forex Signals?

How Does the Learn 2 Trade Forex Signals Service Work?

Is The Forex Signals Service Really Free?

What are Forex Signals Based on?

What to Consider When Choosing a Forex Signals Provider?

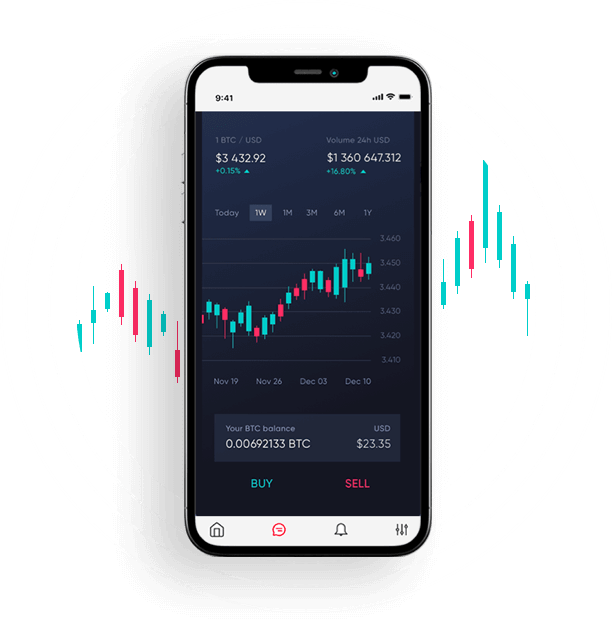

Never Miss a Beat on Trade

All of our forex signals are sent live through Telegram, it can be downloaded on any smartphone and desktop, just turn on your Telegram notifications and get our signals live!

-

Signals are sent live via Telegram

-

All market news

-

Telegram works on all smartphones and desktop

-

Takes less than a minute to set up

-

Join our free Telegram group to test it out

Service for copy trading. Our Algo automatically opens and closes trades.

Service for copy trading. Our Algo automatically opens and closes trades.

Up to 5 signals daily

Up to 5 signals daily